The California Energy Commission (CEC) has announced that it has approved three ethanol producers and four ethanol plants under its Ethanol Producers Incentive Program (CEPIP). If and when the program actually begins, it will pay an incentive to corn ethanol producers who are producing more than 10 million gallons per year and operating in the state; yet today, only one plant is actually in production: Calgren Renewable Fuels LLC.

The California Energy Commission (CEC) has announced that it has approved three ethanol producers and four ethanol plants under its Ethanol Producers Incentive Program (CEPIP). If and when the program actually begins, it will pay an incentive to corn ethanol producers who are producing more than 10 million gallons per year and operating in the state; yet today, only one plant is actually in production: Calgren Renewable Fuels LLC.

The purpose of the CEPIP is twofold; to increase the amount of biofuels produced in the state, and to move corn ethanol plants in the direction of reducing their environmental footprint as part of the Biorefinery Operational Enhancement Goal or BOEG obligations. To achieve these goals, the CEPIP was designed to provide economic assistance to ethanol facilities producing ethanol in California during difficult economic operating conditions. The life of the program is currently set at five years.

There are other states that have incentive programs but according to CEC spokesman Rob Schlichting in an article published in Ethanol Producer Magazine, California’s program is the only one that bases payments strictly on market conditions.

The payments are based on the crush spread CEC established would be 55 cents per gallon of ethanol. If the crush spread averages less than 55 cents per month than ethanol producers receive a payment of up to 25 cents per gallon with the total payment amount capped at $3 million. During months that the crush spread is greater than $1 per gallon, then producers will be required to pay back incentives at the rate of up to 20 cents per gallon of ethanol produced.

There are several ethanol plants currently idle in California due to financial difficulties and Schlichting noted that the program won’t be effective if you don’t have operational plants. He hopes that by getting the word out that producers have been accepted into the program investors will look more favorably on these plants.

Yet in true California ironic fashion, the program is indefinitely delayed due to the state’s financial mess. The program will not move forward until the state has a signed budget and other contractual issues are finalized, which could take months.

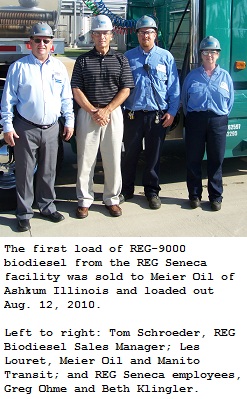

Iowa-based Renewable Energy Group (REG) has held a grand re-opening of its Seneca, Illinois biodiesel plant after taking over the 60 million-gallon-a-year biodiesel and glycerin facility from Nova Biosource Fuels.

Iowa-based Renewable Energy Group (REG) has held a grand re-opening of its Seneca, Illinois biodiesel plant after taking over the 60 million-gallon-a-year biodiesel and glycerin facility from Nova Biosource Fuels.

Seaweed has been getting quite a bit of attention for its potential in ethanol production, especially in Asia. Most recently, scientists from Tohoku University and Tohoku Electric Power announced they have developed a technology to efficiently generate ethanol from seaweed such as sea tangle and sea grape, according to

Seaweed has been getting quite a bit of attention for its potential in ethanol production, especially in Asia. Most recently, scientists from Tohoku University and Tohoku Electric Power announced they have developed a technology to efficiently generate ethanol from seaweed such as sea tangle and sea grape, according to