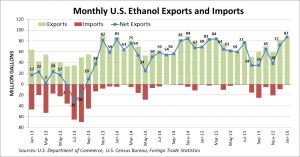

According to Ann Lewis, research analyst with the Renewable Fuels Association (RFA), U.S. ethanol exports increased by 7 percent over December 2015 kicking off 2016 with a strong start. Using U.S. data, the increase marked a 14-month high with the industry shipping 87.1 million gallons (mg), with China taking the lead with a third of the market at 29.4 mg—rivaling the record of 32.6 mg to China last October.

During the same time frame, Canada received just 13.7 mg—the lowest volume of exports north of the border since October 2010. The United Arab Emirates (10.9 mg) and South Korea (10.4 mg) were other top markets in January. Brazil brought in a fairly sizable volume (6.6 mg) considering its recent absenteeism from the U.S. export picture. January’s robust exports equate to 1.05 billion gallons on an annualized basis.

Denatured fuel ethanol exports saw a 29 percent month-on-month increase to 65.0 mg in January. China grabbed 29.4 mg (45%) of that market, with Canada (12.2 mg, or 19%), the UAE (8.1 mg, or 12%) and South Korea (5.9 mg, or 9%). Lewis reports that January exports of undenatured ethanol for fuel use fell 29 percent from December to 20.2 mg. Brazil (6.6 mg) and South Korea (4.5 mg) received 55% of undenatured fuel exports, while the Philippines (2.9 mg), the UAE (2.8 mg), Mexico (2.2 mg) and Peru (1.1 mg) rounded out the list. Sales of undenatured ethanol for non-fuel, non-beverage use crashed to the lowest level since February 2013, dipping 64 percent to 212,369 gallons. Similarly, denatured non-fuel use ethanol exports slumped 21 percent to 1.7 mg—the lowest volume in over a year. The U.S. kept exports of non-fuel product close to home with 78 percent of total shipping to Canada and 9 percent to Mexico.

Denatured fuel ethanol exports saw a 29 percent month-on-month increase to 65.0 mg in January. China grabbed 29.4 mg (45%) of that market, with Canada (12.2 mg, or 19%), the UAE (8.1 mg, or 12%) and South Korea (5.9 mg, or 9%). Lewis reports that January exports of undenatured ethanol for fuel use fell 29 percent from December to 20.2 mg. Brazil (6.6 mg) and South Korea (4.5 mg) received 55% of undenatured fuel exports, while the Philippines (2.9 mg), the UAE (2.8 mg), Mexico (2.2 mg) and Peru (1.1 mg) rounded out the list. Sales of undenatured ethanol for non-fuel, non-beverage use crashed to the lowest level since February 2013, dipping 64 percent to 212,369 gallons. Similarly, denatured non-fuel use ethanol exports slumped 21 percent to 1.7 mg—the lowest volume in over a year. The U.S. kept exports of non-fuel product close to home with 78 percent of total shipping to Canada and 9 percent to Mexico.

The U.S. imported just a splash of ethanol for fuel use in January. Inbound shipments came from Canada (500 gallons) and the Netherlands (165 gallons). Given the paltry import figure, January U.S. net exports of 87.1 mg were the highest since the record month of December 2011.

January exports of U.S. distillers dried grains with solubles (DDGs) fell 19 percent from January to 800,580 metric tons (mt). DDGS exports to China tallied at 218,961 mt, representing a 3 percent decrease over December volumes but an increase in market share (27% of total U.S. exports vs. 23% in December). On a side note, these volumes were recorded despite the country opening an anti-dumping case against the U.S. for DDGs. Other export markets included Mexico at 195,669 mt, Ireland at 48,456 mt, Canada at 47,617 mt, Thailand at 46,838, Vietnam at 45,744 mt and South Korea at 45,046 mt.