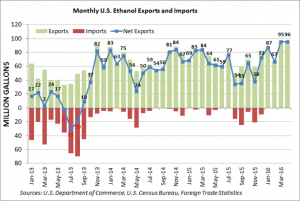

Using new government data, the Renewable Fuels Association (RFA) is reporting that U.S. ethanol exports reached a 52 month high in April totaling 95.5 million gallons (mg), a slight uptick from March of 300,000 gallons and the highest monthly volume since December 2011. Once again China was the top destination receiving 34.5 mg of ethanol. India eked out Canada with 14.6 mg to 14.5 mg respectively. Year-to-date ethanol exports reached 344.9 mg keeping the industry on pace to ship around 1 billion gallons of U.S. ethanol worldwide in 2016.

April exports of U.S. denatured fuel ethanol fell 26 percent from March to 36.9 mg. The majority of product was shipped to China (22.1 mg)–which scaled back its imports of denatured product by 13 mg from March levels–and to Canada (12.6 mg). Peru (1.3 mg) and Jamaica (0.9 mg) were the only other major importers of denatured fuel ethanol in April.

April exports of U.S. denatured fuel ethanol fell 26 percent from March to 36.9 mg. The majority of product was shipped to China (22.1 mg)–which scaled back its imports of denatured product by 13 mg from March levels–and to Canada (12.6 mg). Peru (1.3 mg) and Jamaica (0.9 mg) were the only other major importers of denatured fuel ethanol in April.

Month-on-month exports of undenatured fuel ethanol rose 28 percent to 52.6 mg, with India leading the pack at 14.5 mg. China (12.5 mg), the Philippines (7.1 mg) and Brazil (6.5 mg) were other top importers of undenatured fuel product. Sales of denatured ethanol for non-fuel use expanded to the highest monthly volume in four years at 5.5 mg, with Nigeria’s imports of 3.5 mg accounting for the spike. Canada picked up much of the remaining share of denatured industrial ethanol (1.9 mg). Sales of undenatured ethanol for non-fuel, non-beverage use dropped back to a more typical level of 590,060 gallons after popping to 2 mg in March. Mexico and South Korea together accounted for half of the total volume of undenatured industrial.

For the first time in 20 months, the U.S. did not import a drop of fuel ethanol during April. Year-to-date fuel ethanol imports are just 40,325 gallons, putting the U.S. on pace to import far less than 1 mg in 2016. Meanwhile, EPA continues to project 200 mg of ethanol imports in both 2016 and 2017 to assist in compliance with the RFS advanced biofuel standard.

April exports of U.S. distillers dried grains with solubles (DDGS) expanded again this month, up 7 percent to 883,572 metric tons (mt). Mexico maintained its position as the top market by increasing its offtake to 148,555 mt. Turkey shook up the market with imports of 140,180 mt of U.S. DDGS, bypassing China to become the second-largest market in April. Exports to China continued to languish, showing only a minor increase on the books last month, rising to 125,587 mt. Other export markets of note in April included Vietnam (86,140 mg), South Korea (55,439 mt), Thailand (48,956 mt) and Canada (45,819 mt). Notably, Pakistan re-entered the market in April, buying 41,823 mt of U.S. DDGS. Year-to-date DDGS exports of 3.3 million mt indicate an annualized total of 9.9 million mt. DDGS exports are running nearly 200,000 mt per month behind last year’s monthly average.