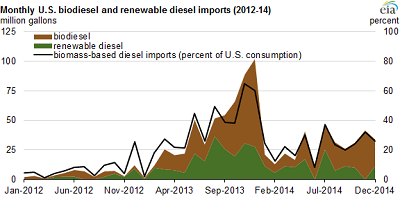

The amount of biodiesel and renewable diesel being imported into the U.S. dropped 36 percent in 2014 compared to the record-level year in 2013. This article from the Energy Information Administration says uncertainty about the Renewable Fuel Standard (RFS) and no late-year influx of volumes from Argentina were two main factors in this decline.

The strongest drivers of the resurgence in U.S. biomass-based diesel demand since 2012 have been increasing RFS targets and the on-again, off-again biodiesel tax credit. Biodiesel and renewable diesel are valuable because they qualify for the two major renewable fuel programs in the United States: the RFS applied at the national level, and California’s Low Carbon Fuel Standard (LCFS). Biomass-based diesel fuels have additional advantages over other renewable fuels because of their relatively high energy content and low carbon intensity, which allow them to qualify for higher credit values in both renewable fuel programs.

While the RFS is meant to encourage the production and consumption of renewable fuels, obligations for 2014 still have not been finalized and those for 2015 have not yet been proposed. The initial proposal for the 2014 RFS program year, released in November 2013, stated that the 2014 biomass-based diesel obligation would remain unchanged from its 2013 value at 1.28 billion gallons, while the advanced biofuels obligation would be reduced to 2.2 billion gallons, down from 2.75 billion gallons in 2013. The uncertainty and proposed lower target levels have made it difficult for refiners to comply with the RFS recently, but the flexibility and value of biomass-based diesel volumes towards all obligation levels make it a strong driver of biodiesel consumption as long as the RFS is still active.

Two other factors help explain lower biomass-based diesel imports in 2014. In late 2013, there was a surge of biodiesel imports from Argentina as a result of European Union (EU) antidumping duties placed on Argentine biodiesel. This action by the EU temporarily diverted large volumes of Argentine biomass-based diesel that were previously destined to be exported to Europe, Argentina’s largest biodiesel export market, to the United States. U.S. imports of biodiesel from Argentina fell by 57% from 2013 to 52 million gallons in 2014.

The EIA also cited the end of the $1-per-gallon federal biodiesel tax credit at the end of 2013, despite the retroactive reinstatement at the end of 2014, as another factor in the decline.

Nearly half of the biodiesel imports coming into the U.S. come from Canada.