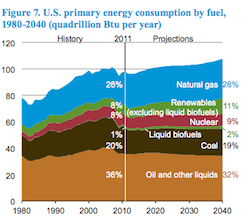

The Energy Information Agency (EIA) has released its 2013 Annual Energy Outlook forecast summary. While the report looks at all forms of energy with estimates going as far as 2040, there were two areas pertinent to biofuels. The summary forecast stated that renewable fuel use will grow at a much faster rate than fossil fuel use, and the share of generation from renewables will grow from 13 percent in 2011 to 16 percent in 2040.

The summary forecasts that while total liquid fuels consumption will fall, consumption of produced biofuels increases significantly, from 1.3 quadrillion Btu in 2011 to 2.1 Btu in 2040, and its share of total U.S. liquid fuels consumption will grow from 3.5 percent in 2011 to 5.8 percent in 2040.

The summary forecasts that while total liquid fuels consumption will fall, consumption of produced biofuels increases significantly, from 1.3 quadrillion Btu in 2011 to 2.1 Btu in 2040, and its share of total U.S. liquid fuels consumption will grow from 3.5 percent in 2011 to 5.8 percent in 2040.

“The increases are much smaller than those in AEO2012, however, as a result of diminished FFV penetration, a

smaller motor gasoline pool for blending ethanol, and reduced production of cellulosic biofuels, which to date has been well under the targets set by the EISA. (EPA issued waivers that substantially reduced the cellulosic biofuels obligation under the RFS for 2010, 2011, and 2012.) In addition, the production tax credit for cellulosic biofuels is scheduled to expire at the end of 2012.”

At first glance the outlook for biofuels looks good, but the ethanol industry doesn’t want the take-away being all is good, but rather cautions that this news is not an invitation to curbing or eliminating the RFS.

“Doing so would only prove their lack of understanding of EIA’s report and, more importantly, show their ignorance of the purpose of the RFS,” said ACE Executive Vice President Brian Jennings. “Congress designed the RFS as a flexible and forward-looking policy to serve as a catalyst for biofuel use, and by design, the RFS is built to help break through the blend wall.”

“EIA, on the other hand, makes its projections based on market conditions and known technology. Ten years ago, the EIA Outlook said we could only make 3.4 billion gallons of ethanol in the U.S. by 2020. Congress deemed that  unacceptable, and passed the RFS to encourage alternatives to oil, and they were right. The RFS works. Our industry produced almost four times that much ethanol two years ago – ten years ahead of schedule.”

unacceptable, and passed the RFS to encourage alternatives to oil, and they were right. The RFS works. Our industry produced almost four times that much ethanol two years ago – ten years ahead of schedule.”

The blend wall is one that is not very high and we’re already at the top but now we can’t get over and down the other side. Scaling the blend wall and increased market access is key, explained Tom Buis, CEO of Growth Energy.

“Currently the blend wall is preventing additional use of biofuels. While grain-based biofuels, such as corn ethanol have not only met, but exceeded the goals, the blend wall has prevented full saturation into the commercial marketplace and has discouraged investments in next generation biofuels.”

Buis added that Growth Energy and the biofuels industry will continue to work with retailers and consumers to educate them on higher blends, such as E15 and continue to garner the support necessary to break through the blend wall.

So if there is one takeaway its this – biofuels are growing and will continue to grow but only if the RFS stays in place and communities across the country work together to bring choice to Americans at the pump.