When President Trump was in Iowa last week and spoke about E15, there were many on social media who asked the question, “What is E15 and why is the president talking about it?”

When President Trump was in Iowa last week and spoke about E15, there were many on social media who asked the question, “What is E15 and why is the president talking about it?”

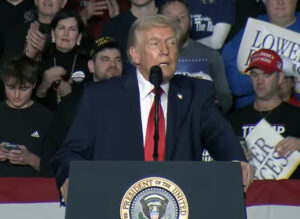

“I promised to support E15 all year round… I am trusting speaker Mike Johnson and Leader John Thune to find a deal that works for farmers, consumers, and refiners, including small and mid-sized refiners, to get E15 approved and they’re working on it and they’re very close to getting it done,” said Trump, during remarks in Clive, Iowa.

The fact is that very few people actually have any clue about E15, and the few who do know what it is, even within the industry, do not understand the issue that has been plaguing it for over a decade – mainly because it is very technical and makes absolutely no sense. It is an issue that cannot be explained in a simple sound bite. Simply saying that we need year-round, nationwide E15 does nothing to explain the issue, especially since retailers have been able to sell E15 during the summer months for the past several years, thanks to waivers.

So, what is the issue? E15 was first approved for use in new vehicles by the EPA in 2010, extended to 2001 and newer vehicles in 2011. This was granted by a partial waiver under the Clean Air Act. However, also under the Clean Air Act, gasoline sold during the summer ozone season (generally June 1–September 15) must meet lower Reid Vapor Pressure (RVP) standards to reduce evaporative emissions (a contributor to smog). E15 typically has a higher RVP than E10 and therefore doesn’t automatically qualify for the summer gasoline waiver that E10 enjoys — meaning E15 normally cannot be sold in most of the U.S. during summer.

That is the problem. Up until 2019, summer sales of E15 were prohibited in those regions with RVP volatility limits. In 2019, President Trump tried to fix the problem by having his first term’s EPA issue a regulatory action to extend the 1-psi RVP waiver to E15 during the summer season.

However, industry litigation led a federal court to determine the agency’s interpretation exceeded the authority in the Clean Air Act. As a result, the seasonal RVP restriction remained in effect in most parts of the country even after that 2019 rule. Since 2022, under President Biden, summer sales of E15 have been allowed by emergency waivers.

The first emergency fuel waivers specifically for summer E15 were issued under CAA Section 211(c)(4)(C) citing “extreme and unusual” fuel supply circumstances in April 2022 under the Biden EPA. These temporary (up to 20-day) waivers have been renewed multiple times each summer since then (2022, 2023, 2024, and 2025 under the Trump EPA), effectively allowing continued nationwide summer sales on a stopgap basis.

The summer restriction on E15 is basically a statutory problem baked into the Clean Air Act (CAA) which sets the Reid Vapor Pressure (RVP) limits for gasoline sold during the summer ozone season (June 1–Sept. 15). Congress wrote a specific 1-psi RVP waiver into the law only for gasoline containing exactly 10% ethanol (E10). That is why Congress is the only pathway for a final fix to the problem because only Congress can amend the Clean Air Act and explicitly extend the 1-psi RVP waiver to E15

or create a new ethanol-neutral standard tied to emissions, not blend level.

Now the question is, what are the chances that this newly-formed E15 Rural Domestic Energy Council can get that done and passed by the end of this month? If I were a betting person, I would not put my money on it.

Chief Ethanol is partnering with Fluid Quip Technologies (FQT) and Whitefox Technologies to revamp, modernize, and innovate the equipment and process systems at its Hastings, Nebraska ethanol facility.

Chief Ethanol is partnering with Fluid Quip Technologies (FQT) and Whitefox Technologies to revamp, modernize, and innovate the equipment and process systems at its Hastings, Nebraska ethanol facility.