Ethanol stakeholders support the U.S. Trade Representative taking action against unfair trading practices by Brazil with a Section 301 investigation.

Ethanol stakeholders support the U.S. Trade Representative taking action against unfair trading practices by Brazil with a Section 301 investigation.

In comments sent Monday to USTR, the Renewable Fuels Association noted Brazil’s punitive ethanol tariff regime and restrictive regulations demonstrate that the country is clearly not committed to fair and reciprocal trade in ethanol.

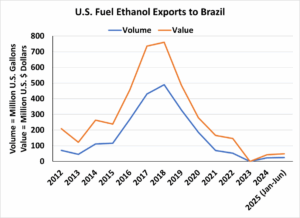

“Brazil’s tariff rates have no doubt had a demonstrable impact on U.S. ethanol exports,” wrote RFA President and CEO Geoff Cooper. “While Brazil was once the top export market for U.S. ethanol, the imposition of tariffs (without a duty-free quota) in recent years has essentially closed the market. To make matters worse, while U.S. ethanol faces a significant 18 percent import duty, Brazilian ethanol enters the U.S. market with just a 2.5 percent ad valorem duty, granting Brazilian producers preferential access and market competitiveness in America.”

National Corn Growers Association (NCGA) President Kenneth Hartman Jr. said there is clear evidence demonstrating that Brazil’s ethanol tariff and other actions are unreasonable, discriminatory and burden U.S. commerce.

National Corn Growers Association (NCGA) President Kenneth Hartman Jr. said there is clear evidence demonstrating that Brazil’s ethanol tariff and other actions are unreasonable, discriminatory and burden U.S. commerce.

“Brazil is actively looking to unseat the historic and obvious success of the American corn industry by a series of trade actions that directly and indirectly harm U.S. corn growers,” Hartman said.

USTR’s Section 301 investigation will allow the agency to determine if a foreign country has taken unfair trade actions that burden or restrict U.S. commerce. Following the imposition of an 18% tariff on U.S. fuel ethanol, exports to Brazil fell to zero in 2023 and just $43 million in 2024. In 2024, exports to Brazil accounted for just 1.3 percent of total U.S. ethanol exports, after accounting for approximately one-third of total U.S. exports as recently as 2018.

USTR initiated the investigation of Brazil under Section 301 of the Trade Act of 1974 in July, citing its actions in several trade arenas, including ethanol market access.

Meanwhile, Brazil submitted its own comments, rejecting the authority of the U.S. Trade Representative (USTR) under Section 301 and saying only the World Trade Organization has the authority to handle trade disputes.

In its 90-page rebuttal, Brazil claims it “maintains an open ethanol market and has not imposed discriminatory barriers against U.S. ethanol.”

Historically, Brazil has maintained tariffs on ethanol well below its bound tariff agreed to as part of its membership to the WTO (i.e., 35 percent). This tariff applies equally to all countries, including the United States, and is lower than the tariff the United States currently applies to Brazil’s exports of ethanol (Brazil’s tariff is 18 percent, whereas the United States’ tariff is now 52.5 percent).

Rep. Dusty Johnson (R-SD) welcomed members of the American Coalition for Ethanol to his home state of South Dakota Thursday as he addressed some of the industry’s current concerns.

Rep. Dusty Johnson (R-SD) welcomed members of the American Coalition for Ethanol to his home state of South Dakota Thursday as he addressed some of the industry’s current concerns.