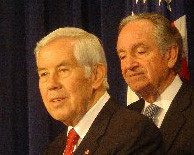

Senators Tom Harkin (D-IA) and Richard Lugar (R-IN) have introduced legislation aimed at helping to efficiently bring ethanol to communities across America by giving pipeline owners the same tax benefits they receive for moving petroleum products.

The tax code currently states that Publicly Traded Partnerships are supposed to earn 90-percent of income from the exploration, transportation, storage or marketing of depletable natural resources like oil, gas and coal. The Harkin-Lugar bill would change the tax code so that these Publicly Traded Partnerships can earn qualified income from the transport, storage or marketing of any renewable liquid fuel approved by the Environmental Protection Agency.

The tax code currently states that Publicly Traded Partnerships are supposed to earn 90-percent of income from the exploration, transportation, storage or marketing of depletable natural resources like oil, gas and coal. The Harkin-Lugar bill would change the tax code so that these Publicly Traded Partnerships can earn qualified income from the transport, storage or marketing of any renewable liquid fuel approved by the Environmental Protection Agency.

Harkin says the bill “makes a simple change to the tax code that meets the demands and realities of the 21st century energy marketplace, removing barriers so that biofuels producers in the Midwest and elsewhere will have an efficient, inexpensive way to transport these renewable fuels to the market.” According to Lugar, “Overcoming problems in moving ethanol through pipelines, as Brazil has done, is important in developing the full promise of America’s renewable fuels.”