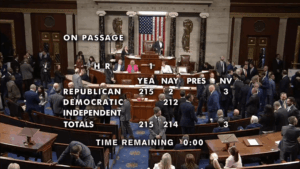

President Donald Trump’s “One Big, Beautiful Bill” passed in the U.S. House of Representatives Thursday morning on a vote of 215-214, with all Democrats and two Republicans voting against. The bill includes several provisions important to America’s ethanol producers and farmers.

President Donald Trump’s “One Big, Beautiful Bill” passed in the U.S. House of Representatives Thursday morning on a vote of 215-214, with all Democrats and two Republicans voting against. The bill includes several provisions important to America’s ethanol producers and farmers.

“In addition to extending the 45Z clean fuel production credit by four years, the bill also reinstates crucial tax benefits that will stimulate research, experimentation, and innovation across the ethanol supply chain,” said Renewable Fuels Association President and CEO Geoff Cooper. “As the bill now moves to the Senate, we hope additional improvements can be made to ensure these tax policies truly drive demand growth for American-made renewable fuels.”

Sustainable Aviation Fuel (SAF) Coalition’s Executive Director, Alison Graab, says the bill extends the Clean Fuel Production Credit (45Z) through 2031. “This legislation provides the long-term certainty SAF producers need to scale operations, drive private sector investment, and benefits American farmers and rural economies. Sustainable aviation fuel is a vital solution for advancing U.S. energy dominance, driving rural economic growth, and establishing the United States as a global frontrunner in SAF production.”

American Farm Bureau Federation President Zippy Duvall says the bill “modernizes farm bill programs and extends and improves critical tax provisions that benefit America’s small farmers and ranchers. Updated reference prices will provide more certainty for farmers struggling through tough economic times. Making business tax deductions permanent and continuing current estate tax exemptions will ensure thousands of families will be able to pass their farms to the next generation.”

The bill includes an increase to the estate and gift tax exemption amounts to $15 million per individual and $30 million per couple, adjusted for inflation annually and makes this exemption permanent. Other provisions include a permanent increase to the Section 199A Small Business deduction from 20% to 23%, expanding the limitation on Section 179 from $1 million to $2.5 million, reinstating the 100% bonus depreciation for five years and extending the Federal Disaster Tax Relief Act of 2023.