The race to take advantage of the expiring federal biodiesel tax credit helped push up profits for the green fuel. Last week, we told you about the University of Illinois analysis on the profitability of ethanol. Well, the analysts from the school are back, and this time they’ve looked into the factors over the past few years that have helped push up biodiesel profits, and fear of losing the credit seems to help that market.

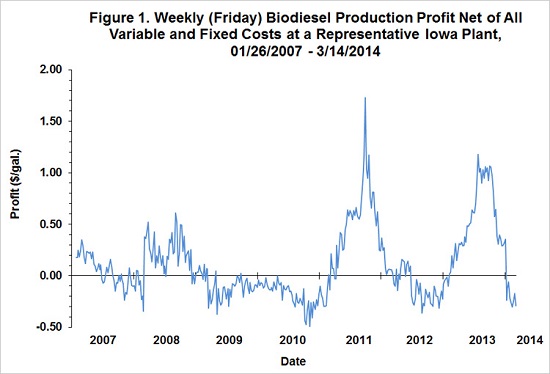

Figure 1 presents the (pre-tax) estimates of biodiesel profits based on the prices and model assumptions… When returns are in the black the average is $0.35 per gallon compared to -$0.16 per gallon when returns are in the red. The two largest spikes in profitability can be traced to the effects of biofuels policies. The first major spike in 2011 was directly attributable to the race by diesel blenders to take advantage of the blender tax credit that was set to expire at the end of 2011. The second major spike in 2013 was also directly attributable to the race by diesel blenders to take advantage of the blender tax credit that was set to expire at the end of 2013 (the credit has yet to be reinstated for 2014). In addition, obligated parties under the RFS needed to incentivize expanded biodiesel production in order to meet the increased biodiesel mandate for 2013 and build up the stock of biodiesel RINs that could be used to fill the “renewable gap” in future years.

The analysts also show that 2013’s profit margin was a whopping 64.3 percent, the highest of the seven years examined, and 2011’s profit was also an impressive 54.4 percent. Overall for the period of 2007-2013, investors in biodiesel operations saw a 14.7 percent profit, more than twice ethanol’s 5.8 percent return on investment during the same period.