The government’s proposed change in how to figure biodiesel and ethanol use for purposes of the Renewable Fuel Standard (RFS) could end up being a boost for the green fuels. This analysis from the University of Illinois looks at how the EPA’s method of “adding-up” the market potential for E10 and E85 ethanol, biodiesel and other non-ethanol fuels changes how we should look at the RFS and Biodiesel Blenders Tax Credit.

In its proposed rule for the 2014 RFS, EPA announced a plan to waive a portion of the RFS from 2014 on, a notable break from previous proposals.

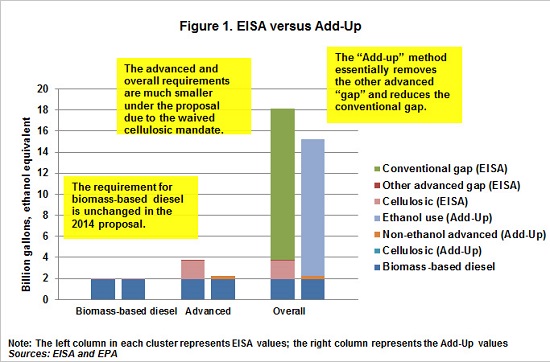

The EPA proposal maintains the hierarchy, but replaces the set targets of the Energy Independence and Security Act (EISA) with annual estimates of how much renewable fuel use is ‘expected’ (Figure 1). The Add-Up method sets the biomass-based diesel requirement at the higher of a base level of 1.28 billion gallons or expected use… Higher RIN prices would appear to lead to additional E85 consumption would then potentially lead to greater future mandates.

A blender’s tax credit, such as the $1.00 per gallon credit given to biodiesel blenders which expired at the end of 2013, gives an incentive to blenders to use more biofuel. Under the EPA’s previous method, the credit may simply make the mandate less costly to achieve… If the RFS was then easy to exceed or if obligated parties wanted extra RINs to carry into the next year, biodiesel use might rise but perhaps not very much. If extra biomass-based diesel was used beyond its own requirement, then it might displace ethanol used for advanced or overall requirements.

The analysis concludes that using the Add-Up method, the RFS renewable fuel requirements will respond to market conditions and other policies, not remain at set EISA targets.