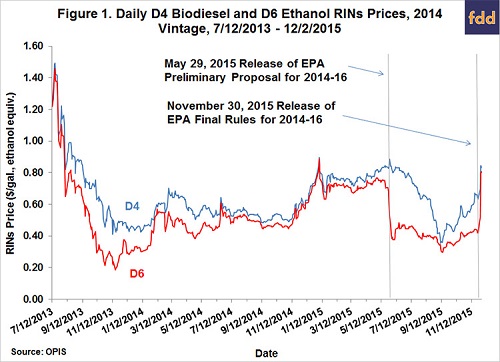

Renewable Identification Numbers (RINs) prices jumped sharply after tge Environmental Protection Agency (EPA) released its final numbers for the amount of biodiesel and ethanol to be blended into the nation’s fuel supply. This analysis from University of Illinois’ Scott Irwin and Darrel Good says not only were the EPA numbers a shock and reflected in the RINs’ prices, but it also shows the relationship between the two green fuels.

The price of D4 biodiesel RINs went up 30 percent and the price of D6 ethanol RINs increased over 90 percent in the three trading days following the release. The market was apparently surprised by how much the final conventional ethanol mandates, particularly in 2016, breached the E10 blend wall. In addition, the final rulemaking clearly signaled that the EPA is serious about getting “the RFS back on track,” and it would not be surprising if the EPA set the conventional ethanol mandate at the statutory level of 15.0 billion gallons as soon as 2017. The prospect of large conventional mandate gaps versus the E10 blend wall evidently shifted the expectation of market participants from one where the existing stock of RINs would not be exhausted for years to one where the stocks could be exhausted in a matter of months. When the stock of RINs is exhausted, the conventional gaps have to be filled by higher ethanol blends, such as E15 and E85, or biodiesel and renewable diesel. Our theoretical model predicts that the price of a D6 ethanol RINs should equal the price of a D4 biodiesel RINs if biodiesel and renewable diesel are the only feasible options for filling conventional mandate gaps. Consequently, the move of D6 RINs prices to nearly the same level as D4 RINs prices in the days following the November 30 release is an unmistakable sign that the market believes higher ethanol blends are not a feasible source of RINs to fill conventional gaps. Instead, biodiesel and renewable diesel are perceived to be the only viable options for filling the expected conventional gaps.