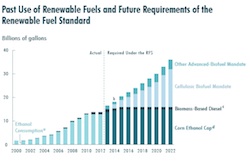

The Congressional Budget Office has released a new report, “Renewable Fuel Standard: Issues for 2014 and Beyond“. The evaluates how much the supply of various types of renewable fuels would have to increase over the next several years to comply with the  Renewable Fuel Standard (RFS). The U.S. Environmental Protection Agency (EPA) has yet to finalize its 2014 proposed rule, that if finalized based on initial numbers, would set the growth of biofuels backwards. The report also examines how other issues, such as fuel prices and emissions would vary by 2017, under three RFS scenarios:

Renewable Fuel Standard (RFS). The U.S. Environmental Protection Agency (EPA) has yet to finalize its 2014 proposed rule, that if finalized based on initial numbers, would set the growth of biofuels backwards. The report also examines how other issues, such as fuel prices and emissions would vary by 2017, under three RFS scenarios:

- The EISA volumes scenario, in which fuel suppliers would have to meet the total requirement for renewable fuels, the requirement for advanced biofuels, and the cap on corn ethanol that are stated in EISA for 2017—but not the requirement for cellulosic biofuels, because the capacity to produce enough of those fuels is unlikely to exist by 2017;

- The 2014 volumes scenario, in which the EPA—which has some discretion to modify the mandates of EISA—would keep the RFS requirements for the next several years at the same amounts it has proposed for 2014; and

- The repeal scenario, in which lawmakers would immediately abolish the RFS.

The report finds that food prices would be similar in all scenarios, including the dismantling of the RFS. However, the report finds that advanced biofuels must increase substantially to meet requirements, and that the increased use of all biofuels would increase the price of fuel at the pump.

In response to the report, Brooke Coleman, executive director of the Advanced Ethanol Council (AEC) noted that the report fails to take into account basic realities when it comes to assessing the program.

“Some reports are simply not worth reading, and this is one of them. You cannot assess the impacts of the RFS without looking at the benefits of reducing consumer demand for gasoline and diesel fuel,” said C oleman. “That’s the entire point of the RFS and the CBO simply states that ‘it did not account for that effect in this analysis.’ To put that omission in perspective, an oil economist recently concluded that the RFS saved motorists at least hundreds of billions of dollars in 2013 by adding the equivalent of an additional OPEC country to U.S. gasoline supplies during times of extreme tightness between supply and demand.”

oleman. “That’s the entire point of the RFS and the CBO simply states that ‘it did not account for that effect in this analysis.’ To put that omission in perspective, an oil economist recently concluded that the RFS saved motorists at least hundreds of billions of dollars in 2013 by adding the equivalent of an additional OPEC country to U.S. gasoline supplies during times of extreme tightness between supply and demand.”

“Whatever the savings are, an analysis of a foreign oil displacement program that does not look at the benefits of displacing foreign oil demand should be dismissed out of hand. The gas price claims are really strange as well,” continued Coleman. “A cornerstone assumption in the report has RFS-RIN prices so high that gasoline retailers could give renewable fuel blends away for free and still make a profit. Needless to say, this is never going to happen. CBO reports are supposed to be impartial and objective, and therefore informative.”

Coleman concluded, “This particular report appears to detail a fantasy world that does not inform the current debate.”