The wind energy tax credit is set to expire tomorrow and unlike last year, there has been virtually no noise from the wind energy industry on the need to save the Production Tax Credit (PTC). In January 2013 Congress extended the tax credit for one year but  structured the credit different in the past. Could this be the reason there has been all but silence from the industry on its expiration?

structured the credit different in the past. Could this be the reason there has been all but silence from the industry on its expiration?

Heading in the the third and fourth quarters of 2012 wind supporters claimed that if the tax credit expired, the industry would all but halt. However this argument has not been heard this year.

While speculation, it could be because when the tax credit was restructured for 2013, it said that a project only has to be in construction by the end of 2013, not completed to qualify for the PTC. But it wasn’t until September of 2013 that the IRS (Internal Revenue Service) released rules that defined a project “in construction” if the project developer has incurred 5 percent of the total capital costs. In addition, the IRS guidelines also stipulate that all the wind turbines for a project must be delivered to the project site by April 15, 2014 and the wind farm must be in operation by December 31, 2015.

Under this structure, the wind industry should remain strong through 2015 and this past month, many companies have announced their wind farm projects have entered the “construction phase”.

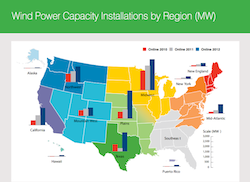

According to the American Wind Energy Association (AWEA), during the forth quarter at least 27 requests for proposals were issued with an estimated 4,175 MW of new wind energy to be generation upon completed. Looking further ahead, reports AWEA, 5,600 MW of new wind projects have secured long-term contracts, and another 1,900 MW have received state regulatory approval.

So how is 2013 shaping up for the wind industry? AWEA reports that American wind energy will finish 2013 with strong momentum for installations in the new year according to the U.S. Wind Industry Third Quarter 2013 Market Report. The industry experienced a painful slowdown at the beginning of 2013 as result of the scheduled expiration of the federal wind energy PTC at the end of 2012, but has now rebounded. However, says AWEA, lack of certainty over federal tax policies continues to keep wind energy from reaching its full potential in the United States.

So how is 2013 shaping up for the wind industry? AWEA reports that American wind energy will finish 2013 with strong momentum for installations in the new year according to the U.S. Wind Industry Third Quarter 2013 Market Report. The industry experienced a painful slowdown at the beginning of 2013 as result of the scheduled expiration of the federal wind energy PTC at the end of 2012, but has now rebounded. However, says AWEA, lack of certainty over federal tax policies continues to keep wind energy from reaching its full potential in the United States.

I would be remiss if I didn’t mention that just last week Senate Finance Committee Chairman Max Baucus (D-Mont.) and Ranking Member Orrin Hatch (R-Utah) have released a tax reform policy for review that would restructure all clean energy taxes including those for wind. The new structure would create a formula to determine how “clean” an energy project is and the tax credits would be divvied out according to how the project fares.

Rob Gramlich, Senior Vice President for Public Policy for AWEA, responded, “We commend Chairman Baucus and the Senate Finance Committee for putting forward a sound policy option to provide domestic energy producers with stability for the years to come. The tax code has a century-long history of incentivizing American-made energy, and we must continue to ensure that we have plentiful, secure, clean, affordable energy to power our economy.”

“Wind energy has already proven that it can deliver in these areas and it must continue to be a critical part of the U.S. energy mix. We appreciate Senator Baucus’ leadership in trying to find common ground to ensure that the U.S. is well-suited to face the energy challenges of the 21st century by promoting a diverse energy portfolio,” concluded Gramlich.

Looking into 2014, the wind industry should keep a close eye on the progression of the policy. In addition, if forecasts are correct, 2014 should see a big year for growth for the wind industry.