A new analysis from the University of Illinois shows traders in Renewable Identification Numbers (RINs) seem to be pretty good at predicting which way the biodiesel market will go. But is there some funny business going on to get those results?

The efficiency of price discovery in the RINs market is quite controversial at the present moment. In just the last few weeks the New York Times published a lengthy piece strongly hinting that the RINs market was being exploited by Wall Street banks for ill-gotten gains and two U.S. Senators asked regulatory agencies to launch investigations. Senator Grassley of Iowa framed the issue this way, “The EPA needs to provide assurances that this market is functioning for its intended purpose, rather than acting as a profit mechanism for Wall Street banks and other financial institutions.”

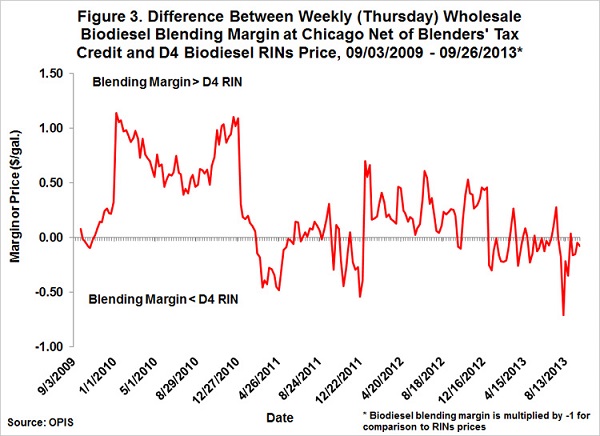

Figure 3 shows the difference between the blending margin and D4 RINs price from September 3, 2009 through September 26, 2013. The average differences by calendar year are as follows:

2010 +75 cents per gallon

2011 -8 cents per gallon

2012 +28 cents per gallon

2013 -10 cents per gallon

Since the tax credit is $1, there is a convenient interpretation of the averages for 2010 and 2012. Assuming the average differences should be zero in equilibrium, the averages indicate the markets’ assessment of the probability that the tax credit will be reinstated retroactively for that year. This suggests that RINs traders thought there was about a 75 percent chance the credit would be retroactively reinstated in 2010 and this chance dropped to 28 percent in 2012. Inspection of Figure 3 reveals there was also considerable variation in the markets assessment of the probability of reinstatement within each year. For example, in 2010 the market estimated the probability near 100 percent early in the year, but it dropped to as low as 40 percent around mid-year, and then recovered back to near 100 percent by the end of the year. There was a particularly sharp recovery in the probability assessment during October 2010.

The analysis concludes that the probability of the tax credit being approved legislatively tracked the ebb and flow of RIN prices, thus also tracking the political process. That allowed RIN traders to correctly predict RIN prices.