*Updated with clarification comments from UNICA*

The president of the Renewable Fuels Association (RFA) this week wrote a letter to the U.S. Trade Ambassador asking for an investigation into news that the Brazilian state of Sao Paulo was imposing a 25% tax on all imported ethanol.

“Because ethanol produced in Sao Paulo is tax exempt, ethanol imported into Sao Paulo from the United States and other areas is at a substantial economic disadvantage,” wrote RFA President and CEO Bob Dinneen to Ambassador Ron Kirk. “We believe this action is discriminatory and may severely—and immediately—restrict the exportation of U.S. ethanol to Brazil.”

“Because ethanol produced in Sao Paulo is tax exempt, ethanol imported into Sao Paulo from the United States and other areas is at a substantial economic disadvantage,” wrote RFA President and CEO Bob Dinneen to Ambassador Ron Kirk. “We believe this action is discriminatory and may severely—and immediately—restrict the exportation of U.S. ethanol to Brazil.”

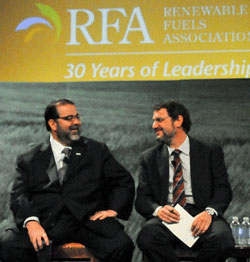

Dinneen is pictured here sharing a lighter moment with Marcos Jank, president and CEO of Brazil’s UNICA during a session at the 2011 National Ethanol Conference.

In early December, the nation of Brazil extended a temporary suspension of a 20% federal tariff on imported ethanol.

“This action not only effectively reinstates the tariff on U.S. exports, but increases it by 5%,” wrote Dinneen. “Moreover, we believe the action taken by the state of Sao Paulo is in violation of Article III:4 of the Generalized Agreement on Tariffs and Trade (GATT) and possibly Article 2.1 of the World Trade Organization’s (WTO) Technical Barriers to Trade Agreement.

Port Santos in Sao Paulo is the main port of entry for U.S. ethanol exports to Brazil, which accounted for an estimated 400 million gallons in 2011.

*In response to the RFA’s letter and resulting media reports, UNICA released a statement from president Marcos Jank noting that the Sao Paulo tax is a pre-existing value-added tax (VAT), known as ICMS (Goods and Services Tax), which is not equivalent to the return of Brazil’s tariff on imported ethanol.

“UNICA would like to clarify that the ICMS is a country-wide tax applied to nearly all products, imported or domestically produced, that has been in place for several years. It is applied by state governments on all anhydrous ethanol,” said Jank. “Contrary to what has been reported, the ICMS on imported ethanol has never been waived. Because Brazilian demand for imported anhydrous ethanol was significantly higher in 2011 than in previous years, the São Paulo state government deferred collection of the ICMS at the customs clearance point to speed up the import process.”

According to UNICA, the deferment period started on October 1, 2011 and is now scheduled to end on March 1, 2011.