A proposed federally-owned “green bank” could finance many renewable energy projects, getting the credit markets for alternative energy moving again and spurring the burgeoning green economy.

A proposed federally-owned “green bank” could finance many renewable energy projects, getting the credit markets for alternative energy moving again and spurring the burgeoning green economy.

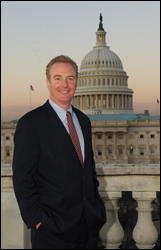

This article from BusinessGreen.com says Congressman Chris Van Hollen’s (D-Maryland) Green Bank Act 2009 would create an organization for lending money to clean energy project owners underwritten by treasury bonds:

Under the proposals, the bank, chartered for 20 years of operation, would help to finance government purchases of renewable energy, make existing energy infrastructure more efficient, and encourage the creation of more local manufacturing capacity for renewable energy. It would also help move the US towards energy independence, said the text of the Act.

The bank would be set up using $10bn in federal funds, and would be able to carry outstanding loans amounting to $50bn in bonds at any single time. It could underwrite up to 80 per cent of a project’s capital expenses, effectively restoring the flow of credit to large numbers of renewable energy projects that have been stalled as a result of the tightening credit market.

One group of backers says the initial $10 billion in capital the bill calls for could finance 15 gigawatts of renewable power.

Significantly, the legislation categorises nuclear plants as clean energy projects, which would make them eligible for a slice of the funding after all other federal funding sources had been exhausted.

The Coalition for Green Bank (CGB), a group of energy companies and advisors, praised the legislation, saying that the initial $10bn capitalisation alone could fund up to 15GW of renewable energy.