As the domestic ethanol industry’s confidence climbs that their ethanol tax incentives will see at least one-year extensions, angry sparks are turning into flames from those opposed to the move. One group in particular that has voiced its opposition to the passing of the Volumetric Ethanol Excise Tax Credit (VEETC) as well as the ethanol tariff is the Brazilian Sugarcane Industry Association (UNICA) who had been claiming for years that American ethanol policy is designed to keep American ethanol in and foreign ethanol out.

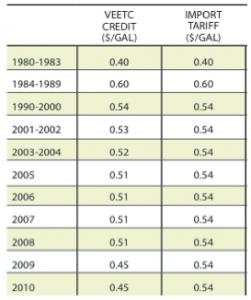

Here is what we know. For more than 20 years, up until 2001, there was “parity” between the two policies, and then that changed when the tariff was set at 54 cents and VEETC at 53 cents. Today, VEETC is at 45 cents and the tariff remains at 54 cents. What is unclear, is where the VEETC will stand should it receive a one-year extension. There was talk that it would be lowered to 36 cents; yet in the current package it remains at 45 cents. Then this morning rumors began en force that there is a possible Senate amendment that would lower the VEETC to 36 cents.

Here is what we know. For more than 20 years, up until 2001, there was “parity” between the two policies, and then that changed when the tariff was set at 54 cents and VEETC at 53 cents. Today, VEETC is at 45 cents and the tariff remains at 54 cents. What is unclear, is where the VEETC will stand should it receive a one-year extension. There was talk that it would be lowered to 36 cents; yet in the current package it remains at 45 cents. Then this morning rumors began en force that there is a possible Senate amendment that would lower the VEETC to 36 cents.

As Joel Velasco, UNICA’s Chief Representative of North America and the author of the blog “Sweeter Alternative” writes, the proposal to reduce the VEETC to 36 cents would in essence, double the difference between the tax credit and the tariff (i.e., the effective trade barrier benefiting corn ethanol) from nine to 18 cents. He notes that the tariff was originally imposed by President Jimmy Carter “to offset the tax credit so that America does not subsidize foreign producers,” but finishes by arguing, “Now some in Congress are trying to change the rules by making the tariff a true trade barrier rather than a subsidy offset.”

For the past year, UNICA has been arguing that true parity is to let both VEETC and the tariff expire and let the free markets take over (Brazil removed its tariff earlier this year). But with the movement in the Senate actually looking like it might go somewhere, UNICA is no longer sending out sparks – they are throwing flames.

“For 30 years, the United States has been subsidizing corn ethanol and imposing trade barriers on imported ethanol. Over the last three years, UNICA has sought to engage with various stakeholders in the United States in an effort to reform U.S. ethanol policy in a way that reduces trade distortions and would avoid trade conflict, said UNICA President & CEO, Marcos Jank. “However, after being rebuffed twice – first in the Bush Administration’s 2008 Farm Bill and now apparently during the Obama lame duck negotiations – it is clear that the United States is not committed to open and fair trade in clean energy, particularly ethanol.”

Jank continued, “Consequently, UNICA will urge the Brazilian government to initiate dispute settlement proceedings at the World Trade Organization (WTO) as soon as this legislation passes Congress and is signed by President Obama. We will have exhausted all options to resolve our differences through informal dialogue and the U.S. legislative process. It will then be time for the WTO to resolve this matter in accordance with applicable international rights and obligations.”

The world will be watching to see if the flames turn into fire as the 112th Congress begin in January 2011.