A proposal to allow exported renewable fuel volumes to count toward RFS compliance would lead to further demand destruction for U.S. ethanol producers and corn growers, according to Renewable Fuels Association Executive Vice President Geoff Cooper, who explains why in a blog post this week.

A proposal to allow exported renewable fuel volumes to count toward RFS compliance would lead to further demand destruction for U.S. ethanol producers and corn growers, according to Renewable Fuels Association Executive Vice President Geoff Cooper, who explains why in a blog post this week.

In addition, Cooper says allowing exports to qualify for the RFS would likely offset any benefit that would come from an RVP waiver allowing year-round sales of E15.

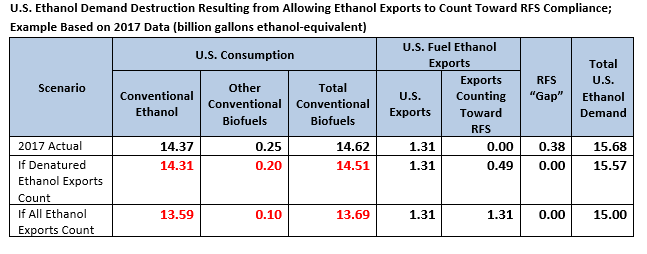

Cooper gives a detailed example using 2017 data that 14.86 billion conventional ethanol (D6) RINs were generated, 492 million gallons (mg) of denatured fuel ethanol were exported, and U.S. ethanol consumption totaled 14.395 bg. The difference between the 15-bg RFS requirement and actual ethanol consumption creates a “gap” of roughly 600 mg, on which the price for RINs.

If denatured ethanol exports were allowed to count toward RFS compliance, the RFS “gap” in this example would have been erased entirely in 2017, as all 15.1 billion D6 RINs (14.86 billion RINs from conventional ethanol and 245 million from renewable diesel) would have remained available for compliance. RIN prices would have plummeted in this case, likely to 10 cents or less.

The entire analysis is very detailed and should be required reading for anyone in the industry to explain why the RFS regulations were correctly written in a way that disallows exports from counting toward RFS compliance – and why it should stay that way.