An analysis shows what might seem obvious, but fills in the gaps of why, that biodiesel production responds positively to profitability. In another quality piece from Scott Irwin with the University of Illinois, he breaks down how staying in the black helps the green fuel.

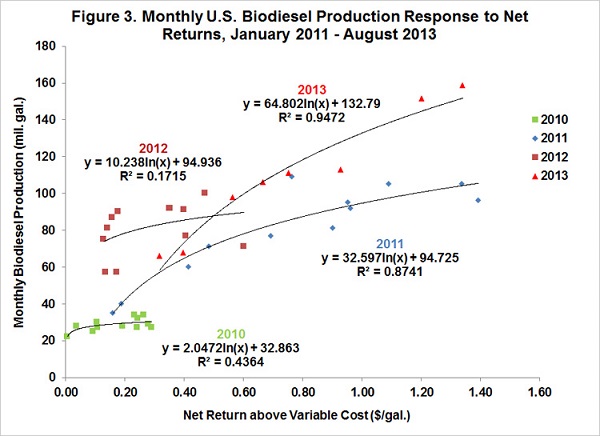

A more detailed view of production responsiveness is shown in Figure 3. Basically, production in this scenario is “stuck” at the mandate regardless of the level of returns (more technically, shifts in supply and demand curves do not change market quantities over a wide range of outcomes). The flat fitted regression lines for 2010 and 2012 in Figure 3 confirm this observation. One has to be careful to avoid the mistake of arguing that when the tax credit is restored a more normal upward sloping response curve will be observed. If market participants expect the credit to be in place permanently then market prices will adjust but production will remain stuck at the mandate. However, if market participants expect the credit to expire at the end of a calendar year then there is an obvious incentive for blenders to bid up the price of biodiesel in order to increase production and take full advantage of the credit before it expires. This appears to be exactly what happened in 2011 and is currently happening in 2013. In essence, these unique market circumstances provide an opportunity to learn something about the responsiveness of biodiesel production to profitability even though a seemingly binding RFS mandate is in place.

Irwin concludes that biodiesel production is quite responsive to profitability, if the right market conditions are present. He says the “next challenge is to determine whether a supply curve based on the estimated relationships in combination with a demand curve can replicate the prices of D4 RINs actually traded in the marketplace.”